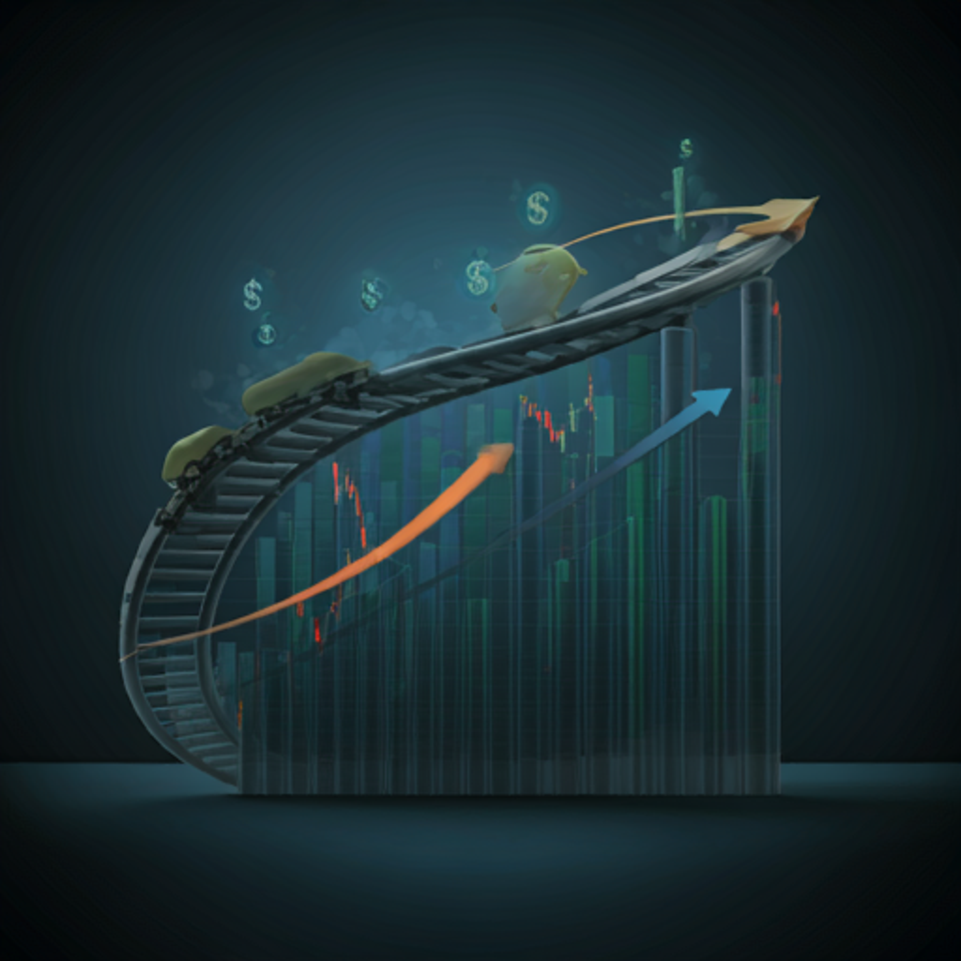

Navigating the Stock Market Rollercoaster: Tips for Investors

What is Market Volatility?

Market volatility refers to the degree of variation in trading prices over time. It is a crucial concept for investors, as it indicates the level of risk associated with a particular asset . High volatility often signals uncertainty in the market, which can lead to significant price swings. Investors must understand that these fluctuations can present both opportunities and challenges.

For instance, during periods of high volatility, prices can rise or fall dramatically within short time frames. This can create potential for profit, but also increases the risk of loss. Many investors find this environment stressful. It is essential to remain calm and make informed decisions. Understanding market volatility is key to navigating investment strategies effectively.

Historical Context of Market Fluctuations

Market fluctuations have been a constant feature of financial history, influenced by various economic, political, and social factors. For object lesson, the Great Depression of the 1930s caused unprecedented market instability. This event reshaped investor behavior and regulatory frameworks. Understanding these historical contexts is vital for modern investors.

Additionally, the dot-com bubble of the late 1990s serves as a reminder of speculative excess. Many investors lost significant capital during that period. Such events highlight the imporhance of due diligence. Historical analysis can provide insights into current market dynamics. Investors should learn from past mistakes.

Factors Contributing to Volatility

Market volatility is influenced by several key factors that investors must consider. Economic indicators, such as inflation rates and employment figures, can significantly impact market sentiment. When these indicators fluctuate, they often lead to rapid changes in stock prices. This can create uncertainty for investors.

Additionally, geopolitical events, such as elections or international conflicts, can trigger volatility. These events often lead to market reactions based on perceived risks. Investor psychology also plays a crucial role. Fear and greed can drive irrational market behavior. Understanding these factors is essential for making informed investment decisions. Knowledge is power inwards investing.

Impact of Volatility on Investment Strategies

Volatility significantly impacts investment strategies, requiring careful consideration. Investors often adjust their approaches based on market conditions. For instance, during high volatility, many may adopt a more conservative strategy. This can include:

These adjustments help mitigate risks. Additionally, some investors may seek opportunities in volatile markets. They might employ strategies like short selling or options trading. Such tactics can be risky. Understanding the implications of volatility is crucial for effective decisiom-making. Knowledge leads to better outcomes.

Risk Management Strategies

Diversification: Spreading Your Investments

Diversification is a fundamental strategy for managing investment risk. By spreading investments across various asset classes, he can reduce the impact of poor performance in any single area. This approach helps to stabilize returns over time. It is essential to include different sectors, such as stocks, bonds, and real estate.

Additionally, geographic diversification can further mitigate risks. Investing in international markets can provide exposure to growth opportunities. He should also consider varying investment styles, such as value and growth investing. This strategy can enhance overall portfolio resilience. A well-diversified portfolio is less likely to experience extreme fluctuations. It promotes long-term financial health.

Setting Stop-Loss Orders

Setting stop-loss orders is a critical component of risk management in investing. These orders automatically sell a security when it reaches a predetermined price. This mechanism helps limit potential losses in volatile markets. By implementing stop-loss orders, he can protect his capital effectively.

Moreover, determining the appropriate stop-loss level is essential. It should reflect his risk tolerance and market conditions. A well-placed stop-loss can prevent emotional decision-making during downturns. Investors often overlook this strategy. However, it is vital for maintaining a disciplined approach. A proactive stance can safeguard investments.

Understanding Your Risk Tolerance

Understanding risk tolerance is essential for effective investing. It refers to an individual’s ability to endure fluctuations in investment value. Assessing this tolerance involves evaluating both financial capacity and emotional resilience. He should consider his investment goals and time horizon.

Additionally, personal circumstances, such as income and expenses, play a significant role. A higher risk tolerance may lead to greater potential returns. However, it also comes with increased volatility. Investors must be honest about their console levels. This self-awareness can guide investment choices. A clear understanding fosters better decision-making.

Using Hedging Techniques

Using hedging techniques is a strategic approach to managing investment risk. These techniques involve taking offsetting positions in related assets. For example, an investor might use options or futures contracts to protect against potentiai losses. This can help stabilize returns during market fluctuations.

Moreover, hedging can be tailored to specific risk exposures. He should assess which assets require protection. By doing so, he can implement targeted strategies. While hedging can reduce potential losses, it may also limit gains. Understanding the trade-offs is crucial. A well-planned hedge can enhance overall portfolio resilience.

Timing the Market: Myth or Reality?

The Concept of Market Timing

The concept of market timing involves making investment decisions based on predicting future market movements. Many investors believe they can buy low and sell high by accurately forecasting these changes. However, this approach is often criticized as unrealistic. Timing the market can lead to missed opportunities.

Key factors to consider include:

He should recognize that even experienced investors struggle with timing. Relying solely on market timing can increase risk. A more effective strategy may involve a long-term investment approach. Consistency often yields better results. Understanding market timing is essential for informed decision-making.

Analyzing Market Trends

Analyzing market trends is crucial for making informed investment decisions. By examining historical price movements and patterns, he can identify potential future directions. This analysis often involves using technical indicators, such as moving averages and relative strength index (RSI). These tools help assess market momentum and potential reversals.

Additionally, understanding broader economic factors is essential. Economic data, such as GDP growth and unemployment rates, can influence market trends. He should also consider geopolitical events that may impact investor sentiment. Recognizing these elements can provide valuable context. A comprehensive analysis leads to better investment strategies. Knowledge is key in navigating market complexities.

Indicators to Watch

When considering market timing, several key indicators can provide valuable insights. First, moving averages help smooth price data to identify trends. They can indicate potential support or resistance levels. Second, the relative strength index (RSI) measures the speed and change of price movements. An RSI above 70 may suggest overbought conditions, while below 30 indicates oversold conditions.

Third, volume analysis is crucial for confirming trends. High trading volume often validates price movements. Fourth, economic indicators, such as inflation rates and employment figures, can influence market sentiment. He should monitor these closely. Understanding these indicators can enhance decision-making. Knowledge empowers investors to navigate market complexities.

Long-Term vs. Short-Term Investing

Long-term investing focuses on holding assets for several years, allowing for growth through compounding returns. This strategy often involves less frequent trading, which can reduce transaction costs. He can benefit from market fluctuations over time. In contrast, short-term investing aims to capitalize on immediate price movements. This approach requires active management and quick decision-making.

Key differences include:

He should assess his financial goals and risk tolerance. Understanding these strategies can guide investment choices. Knowledge is essential for effective investing.

Emotional Discipline in Investing

The Psychology of Investing

The psychology of investing plays a crucial role in decision-making. Emotional discipline is essential for maintaining a rational approach during market fluctuations. Investors often experience fear and greed, which can lead to impulsive actions. He must recognize these emotions to avoid detrimental choices.

Key psychological factors include:

Developing emotional discipline requires self-awareness and a clear strategy. He should establish predefined rules for buying and selling. This structured approach can mitigate emotional responses. Understanding psychology enhances investment effectiveness.

Avoiding Panic Selling

Avoiding panic selling is crucial for maintaining investment stability. During market downturns, fear can drive impulsive decisions. He must recognize that selling in a panic often leads to losses. Establishing a clear investment strategy can help mitigate this risk.

Key strategies include:

These practices promote rational decision-making. He should also focus on long-term objectives. Emotional responses can cloud judgment. Staying informed can reduce anxiety during market fluctuations. Knowledge is empowering in investing.

Staying Focused on Your Investment Goals

Staying focused on investment goals is essential for long-term success. Clear objectives provide direction and help mitigate emotional reactions. He should establish specific, measurable, achievable, relevant, and time-bound (SMART) goals. This framework enhances clarity and accountability.

Additionally, regularly reviewing progress is vital. He can adjust strategies based on performance and market conditions. Maintaining a disciplined approach prevents distractions from short-term market fluctuations.

Key practices include:

These steps reinforce commitment to investment goals. A focused mindset fosters resilience during market volatility. Knowledge and preparation are crucial for effective investing.

Building a Support Network

Building a support network is crucial for maintaining emotional discipline in investing. Surrounding oneself with knowledgeable individuals can provide valuable insights and encouragement. He should seek mentors, financial advisors, and like-minded peers. This network can help him navigate market challenges effectively.

Additionally, participating in investment groups or forums can foster collaboration. Sharing experiences and strategies enhances learning opportunities.

Key benefits of a support network include:

These connections can reinforce commitment to long-term goals. A strong support system promotes confidence and informed decision-making. Knowledge shared is power gained.

Leveraging Technology and Tools

Using Trading Platforms Effectively

Using trading platforms effectively is essential for successful investing. He should familiarize himself with the platform’s features and tools. This includes understanding order types, charting capabilities, and analytical tools. Mastering these elements can enhance trading efficiency.

Key features to utilize include:

He must also practice risk management through position sizing and stop-loss orders. These strategies help protect capital during market fluctuations. A well-optimized trading platform can significantly improve performance. Knowledge is crucial for effective trading.

Analyzing Data with Technical Analysis Tools

Analyzing data with technical analysis tools is vital for informed trading decisions. He should utilize various indicators to assess market trends and price movements. Common tools include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). These indicators help identify potential entry and exit points.

Additionally, chart patterns can provide insights into market behavior. He must recognize formations such as head and shoulders or double tops. These patterns often signal reversals or continuations.

Key benefits of technical analysis include:

Understanding these tools can lead to better investment outcomes. Knowledge is essential for effective analysis.

Staying Informed with News Aggregators

Staying informed with news aggregators is essential for effective investing. These platforms compile information from various sources, providing a comprehensive view of market developments. He should regularly check these aggregators to stay updated on economic indicators and industry news. Timely information can significantly impact investment decisions.

Key features to utilize include:

By leveraging these tools, he can enhance his understanding of market dynamics. Staying informed fosters better decision-making. Knowledge is power in the investment landscape.

Utilizing Automated Trading Systems

Utilizing automated trading systems can enhance trading efficiency and accuracy. These systems execute trades based on predefined criteria, removing emotional biases. He can set parameters such as entry and exit points, allowing for disciplined trading. This approach can lead to consistent performance over time.

Key advantages include:

By automating strategies, he can focus on broader market analysis. This allows for better resource allocation. Knowledge of these systems is essential for modern trading.